About Us

Background

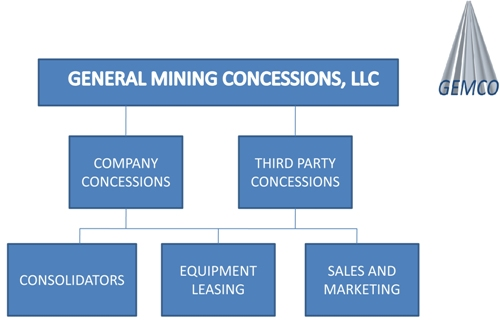

General Mining Concessions, LLC (GEMCO), a New York limited liability company, was formed in 2009 and later filed as a State of New York limited liability company to develop existing small-scale lead and silver mining sites in Peru. Small-scale mining, the extraction of ores by the use of hand tools such as picks and shovels, is practiced in small Latin-American countries such as Peru. It is considered as a way for poor families to escape from poverty and start to climb the economic ladder. GEMCO has been acquiring the rights, known as concessions, to mine these small-scale lead and silver mining sites and to introduce modern techniques and knowledge combined with improved infrastructure, which will result in significantly higher and more efficient extraction and production. These larger tonnages will permit GEMCO to sell directly to refineries and/or to metal traders. GEMCO is currently mining one concession through an outside venture and it plans to complete the first sale of its production in April 2010.

General Mining Concessions

Our Mission

To acquire and exploit the concessions of new and existing small-scale metal mining operations in South America that indicate the potential to return original investment within one year of production and that also have the possibility of returning many times the original investment over a period of five years, with an ultimate goal of an exiting plan by a sale to a significantly larger mining company or by going public through an I.P.O. or a reverse merger.

Our Business

General Mining Concessions, LLC is in the non-ferrous metal business. We mine, concentrate, consolidate and trade metal containing ores. We acquire concessions, the right to mine and remove the metal-bearing ores located in a specific site. We are currently acquiring concessions in Peru and have already begun mining one of the sites. Additionally, we purchase metal containing ores from smaller independent miners and consolidate them for sale.

Target Markets

Our mining production and the consolidation of the mining production of others will be sold directly to both refineries and large metal traders. Worldwide markets already exist for both lead and silver, two important metals contained in our ore.

Our Business

General Mining Concessions, LLC is in the non-ferrous metal business. We mine, concentrate, consolidate and trade metal containing ores. We acquire concessions, the right to mine and remove the metal-bearing ores located in a specific site. We are currently acquiring concessions in Peru and have already begun mining one of the sites. Additionally, we purchase metal containing ores from smaller independent miners and consolidate them for sale.

Our Industry

Initially, our two products for sale will be lead and silver, both contained in ore from our mining and consolidation operations. The single most important commercial use of lead is in the manufacture of lead-acid storage batteries. Although lead’s malleability and corrosion resistant still make it useful for roof flashings and cladding, the main benefits are derived from harnessing lead’s chemical properties. Lead acid batteries are the mainstay of storage technologies for renewable energy sources, such as solar cell and wind turbines and they are used to power cars, trucks, buses, motorbikes, electric vehicles and hybrid vehicles. Lead acid batteries are vital as a back-up emergency power supply in the event of commercial mains power failure in hospitals, telephone exchanges, mobile phone networks, public buildings and for emergency services. Lead’s incredible density provides unrivalled protection from radiation and is essential to staff working in hospitals, dental surgeries, laboratories and nuclear installations. Lead compounds are added to some PVC products to improve durability. Additionally, thousands of miles of underwater power and communication cables are protected by lead sheaths. The price of lead has risen from approximately $440 per tonne in 2000 to the current price of approximately $2300 per tonne. Industrial demand is the primary consumer of silver. Its conductivity, ductility, malleability and bactericidal properties have offset the previous photographic demand. It is now used for its conductivity and for its bactericidal properties. Silver’s exceptional conductivity creates its demand in printed circuits, mobile phones and solar cells. Its bactericidal properties find uses in clothing, bandages, refrigerators and water purifiers. It is also used in the manufacturing of solder and mirrors. Jewelry is the second largest use for silver and about 25% of the demand comes from photography, x-rays, coins and silver medals. The price of silver has risen from approximately $5.00 per troy ounce in 2000 to the current price of approximately $16 per troy ounce. Technological advancements have fed, and continue to feed, the long-term demand and subsequent price growth of both lead and silver. Our long-term plans include the acquisition of additional concessions and the expansion of the area in which we will be purchasing these metals through our Consolidation Division.

Business Description

Our metal business has several components, namely:

- acquiring concessions to mine

- mining these concessions

- concentrating the ore thus mined

- concentrating the ore thus mined

- purchasing and consolidating the production of smaller concessions owned by others

- converting the mined and concentrated ore into United States dollars by sending it to refineries or by selling it to international metal traders

Peru is a country rich in non-ferrous metal bearing ores, including lead, silver and gold. It is the largest producer of silver in the world, the second largest producer of copper, the third of zinc, the fourth of lead and the fifth of gold. These ores are mined by the landowners or the owners of mineral rights known as concessions. Many native Peruvians literally live off the land, that is, they derive their income by mining. Some work for huge mining companies as employees and, at the other extreme, some work their own small property or property on which they have obtained a concession. Many of these natives are very poor and cannot afford power tools. They literally use hand tools such as picks and shovels to remove the ore or the precious metal and, when they have sufficient weight, deliver it to a buyer via a burro, donkey or pick-up truck. The income thus derived pays for such items as their rent, food and clothing. They often do not accumulate enough capital to invest in modern and more efficient equipment such as bulldozers, front-end loaders, compressors, etc One of the procedures used in developing a metal mining site is to drill, at a cost, which can run into tens of millions of dollars, enough test boring holes to determine the location and direction of the vein. Having thus invested a huge amount of money in exploration, the so-called proven reserves must be large enough to project a substantial profit after recovering the exploration costs and the costs to recover the metal and convert it into dollars.

GEMCO has a different philosophy. We seek outcrops, locations where the ore is at or very near the surface. We plan to drill relatively shallow test borings to determine if there is sufficient ore easily accessible so that projections indicate the investment can be returned in less than one year of production. This puts GEMCO in the unique position of avoiding the largest gamble in drilling to recover metals, namely, having invested significant sums of money in the hope of finding large economical-to-mine deposits. Furthermore, rather than purchase the land and the mineral rights, GEMCO will continue to obtain concessions, i.e., the right to mine unlimited tonnage by paying a small monthly fee, usually with minor profit participation for the owner. These concessions are often available because the landowner does not have the capital to invest in a mining operation. Usually, these lands have passed down through several generations and the current landowners are willing to lease the concessions for a small monthly fee plus a minority share in the net profits from the mining operation. In some instances, the mining rights have already been given out as a concession, but the concessionaire lacks the necessary investment capital and is willing to sub-lease the concession to GEMCO as a third party.